BREAKING NEWS: Groundbreaking New Trading Strategy:

Unlock Wall Street's Secrets with iWave Pro - Your Trading Revolution Awaits!

Watch this video before you sign up:

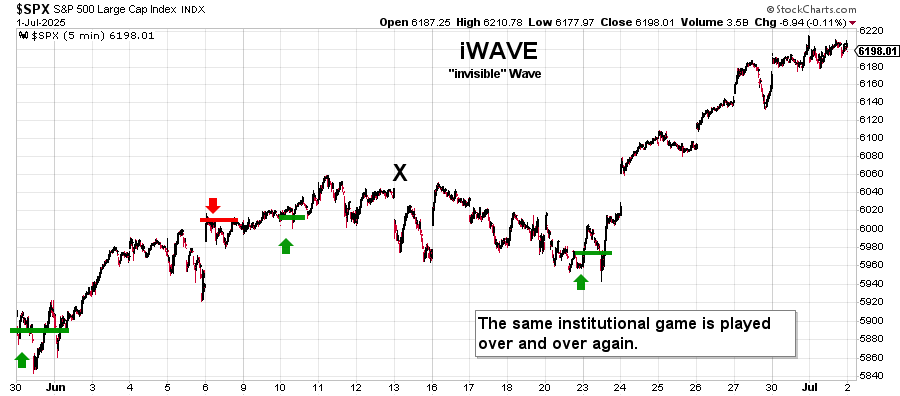

See what iWave analyzes that really moves the markets

Discover the power of the iWave data and what you get as a member with a preview of 5 reports!

In the fast-paced trading world, having clear insights into market movements is invaluable. iWave Pro provides a daily information sent after the market opening, offering a proprietary analysis based on what we believe truly moves the markets. Algorithms, large hedgers, net cash inflows & market makers power to push prices toward a specific area to balance with current economics. iWave Pro offers a unique edge over other analysis THAT OTHERS DO NOT HAVE!

In this vide we will reveal everything about the iWave Pro complete mentorship program.

"It’s been over 40 years since I took my first trade in the markets back in the 1980s. The iWave Pro is my finish line. It offers an unprecedented peek into the real movements of major market players, promising a strategic advantage by predicting market trends with remarkable accuracy.

Join us as we explore how the iWave Pro’s innovation could potentially transform your trading strategy and level the playing field against the industry’s most formidable participants.”

- G.P.C.

“Unlock your iWave advantage to your trading. Personal Audit of what this can do for your current trading.

In just 15 minutes, we can review your current approach and how iWave can benefit you or you can look into what the iWave is doing right now

On This Call You'll

Map out your biggest issues with trading.

See what level of market predicting ability you want.

A close look at what the iWave can do for you.

Receive a custom “next step” analysis to a higher level.

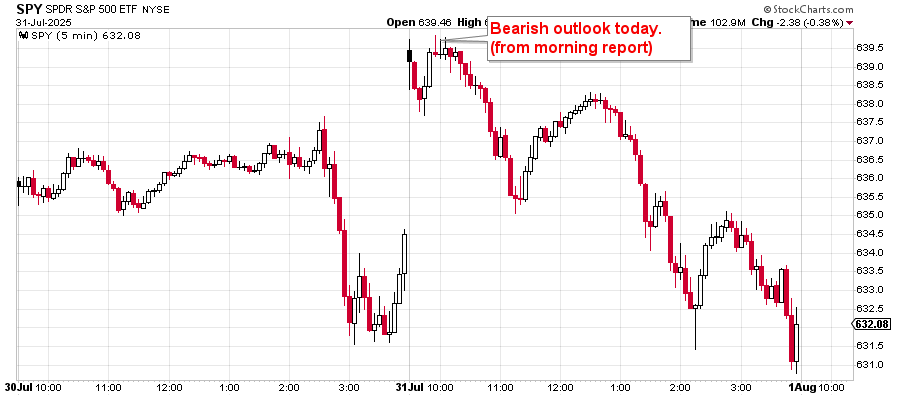

Mastering the Market: Unveiling Short-Term Strategies for the S&P 500

🔍 Discover the pulse of the market through crystal-clear analysis of the S&P 500.

🔹Master the art of short-term trading using our innovative proprietary system.

🔹Receive 3 to 5 high-confidence trading signals per month, designed to identify key market tops and bottoms.

🔹Each signal is backed by meticulous institutional-grade market analysis for maximum edge.

🔹Perfect for traders seeking:

Sharper entry and exit strategies

Reliable swing trading setups

A proven edge in short-term market direction

🔹Join a community committed to transforming your trading through precision and insight.

(Total Value: $2997.00)

Included In This Amazing Offer!

Decoding the Future: Navigating the Medium-Term Trends of the S&P 500

📈 Gain insightful analysis of the S&P 500’s medium-term trends to trade with greater confidence.

🔹You’ll know the greater trend.

🔹Identify key areas large funds are moving into and out of the market.

🔹Understand institutional activity and

How it forecasts the next movement.

🔹Anticipate major shifts in the market

With data-driven insights.

🔹Ideal for traders wanting less trading

and move investing with larger moves.

(Total Value: $2997.00)

Included In This Amazing Offer!

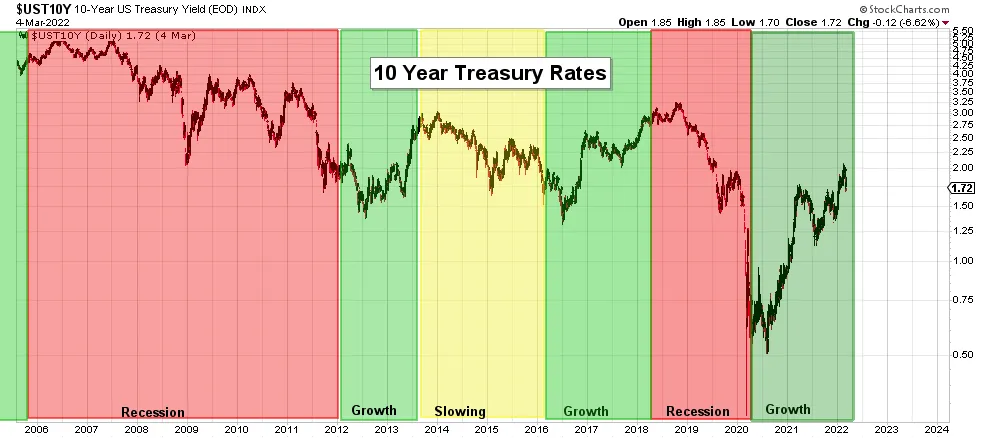

Unlocking the Future: Navigating the Long-Term Trajectory of the S&P 500

📊 Exploring the S&P 500 market through the unknown net cash inflow strategy leading into economic modeling.

🔹Using the powerful data of net cash inflow to properly predict equities.

🔹Understanding how the largest economic markets flow together, creating the value behind all the large cash inflow into equities.

🔹Accessing 20 years of S&P 500 trend analysis, showing how economic shifts affect where the stock market is going in the next 1-3 years.

🔹Understanding the larger market future by monitoring Hedge fund analytics.

Perfect for investors who want to:

🔹See the bigger picture behind market movement

🔹Navigate market cycles with clarity and confidence

🔹Make informed decisions using institutional-grade insights

(Total Value: $2997.00)

Included In This Amazing Offer!

Unlocking Market Movements: Mastering Gap Directions with iWave Pro

“This is only available for the upgraded iWave Professional service.”

⚡ Harness the power of gap prediction to anticipate major intraday market movements—before they happen.

🔹Accurately forecast next-day market gaps caused by overnight news, earnings, or economic reports.

🔹Tackle one of the biggest trading challenges: uncertainty from overnight volatility.

🔹Leverage years of research to "front run" institutional activity by analyzing end-of-day market behavior.

🔹Gain a decisive edge by tracking the moves of major market players before reports are released.

🔹Eliminate emotional decision-making with a system designed to make trades predictable and precise.

🔹Reduce risk and boost consistency in your day trading by understanding institutional behavior and intent.

Ideal for traders who want to stay one step ahead of the market and capitalize on daily momentum shifts.

(Total Value: $2997.00)

Included In This Amazing Offer!

“This is only available for the upgraded iWave Professional service.”

Right now you can access Frank's complete Legacy Collection - the extensive library of training and templates containing the exact strategies that made him a household name in the digital marketing industry!

100,000

Clients served over the last two decades

17

Of the World's most successful premium products

1

Incredible low price for lifetime access today!

*Includes lifetime access to all 38 premium courses, tools and templates for one low payment of just $297 today

W A R N I N G: : Due to incredible amount of value we are giving to the pubic, finally bringing to you access to the large player data that are behind each price move, we will only be taking small groups as new members each 3 months. We will have waiting lists for late comers.

FREQUENTLY ASKED QUESTIONS

Why only quarterly or yearly offers?

The truth is, we just added a Quarterly offer as well for our Private Members Association. in the past we've done monthly offers and it becomes an administrative pain which is not why we run this service. We want what you've all wanted with trading/investing Freedom. The Freedom doesn't exist with monthly headaches and we'd rather spend our time analyzing the markets. If you ever run a monthly administrative business you'll know exactly what i mean. That is the simple fact of it. I can tell you something else like the big marketers do to sell more memberships but we're more interested in being open. The annual offers for Private members is $2497 YET THE DISCOUNT is only $1497. I'm giving you $1000 !!!.

Do you only analyze the SPY and $SPX?

No, they are only the primary markets for the Daily Morning report. However for the Weekly report I analyze several markets, sectors, individual stocks for you that are important for the overall economy and especially the stock market. As for the SPY & $SPX, These 2 indices encapsulate the broadest view of the overall stock market. $SPX is 500 diversified stocks and the SPY mirrors it and you can trade it with 3 options expirations per week which is awesome.

If you would like to trade any of the others that mimic it you're welcome to. We do not dictate what you are to do with the information. We just give you what we can to quickly and accurately analyze and send out which is the most important part.

The SPY has 3 option expirations per week (Monday, Wednesday, Friday) unless there is a holiday then expirations for the week can be adjusted and are sometimes on a Tuesday or Thursday (it is different for each holiday) which makes it highly attractive to short term option traders.

For example, if you have a good idea of the direction of the day or even from today to tomorrow is going to be UP then you can take advantage of buying short term CALLS or in selling the massive erosion in the PUT premiums. The profit possibilities of knowing the intraday and multi day moves are ABUNDANT to say the least. We show you in advance what to look for and how they do it. You merely need to pay attention and be ready.

Do I need to watch the market all day?

Absolutely not. I dont. In a very short time as you get better and better and reading these markets with this information, you will quickly come to find out what i am saying is the truth of the market which is..."Institutions are primarily in the markets the first 90 minutes and last hour of the day. So, that's when they give us the signals of what they are going to do."

You can watch in those times or just take a peak in the morning or in the afternoon. Choose. Its up to you For example, this past week of October 5th, i knew the AIT was bullish, the hedge areas showed bullish activity and the price moved far away from the last hedge area so there was nothing for me to look at. I set an alarm on my phone if price were to come back down and i went about my day.

You will get very comfortable with how and when to analyze the markets.

Is this for Day Traders, Swing Traders or Long term Traders?

All experienced traders know that when you are a trader you are a trader. Period. Knowing direction during all time frames is pertinent. If nothing else, its at least comforting.

The hedge areas are the shortest term information we have however it not only is short term for the day because it also confirms Buying and Selling showing the dominant trend. if confirms the AIT direction which multi day movements.

Then of course for your wealth building long term purposes we have our long term analysis which is a modified version of many institutional models that have been viewed and examined over the years. It involves 9 economic factors and data sets. For the most part it is simple and uses 3 data sets however during certain economic conditions other factors / data must be implemented because the market does not always follow the same Data by the same rules.

What do you teach during my membership?

Along with the morning report and Weekly report, we teach you the institutions create the directions, period. (which is worth more than any $10,000.00 seminar alone), the value trends and how to use them. We teach you daily and weekly how to analyze the situations so you know it and see it as well as we do.

We believe we know each day which direction the market is going with a HIGH degree of accuracy through the revealing information given as to what the big guys are up to. That being said, we also know when to say "I dont know which direction they are going, but i know where the hedge areas are, i know which direction the AIT is pointed so i know where i should be positioned."

With our Weekly / Monthly analysis you will see the economic factors at work in our longer term models that affect the markets beautifully.

How do we use the information you provide?

The rude answer is "However you want". but it is the most honest and simple answer. Only a day or a week or two of staring at it daily will open your mind to endless possibilities. You will see the power of it and probably wont be able to stand on the sidelines any longer and just watch as you see these large moves.

But that being said, we give you the information each morning after the open (5-30 minutes depending on market situation) and also what we are expecting and/or looking for from the markets and how they are or could be reacting to it all day.

When and how often will the report come?

The report comes every morning after the open because pertinent information is coming into our analysis right at that time so it takes a few minutes to report to you.

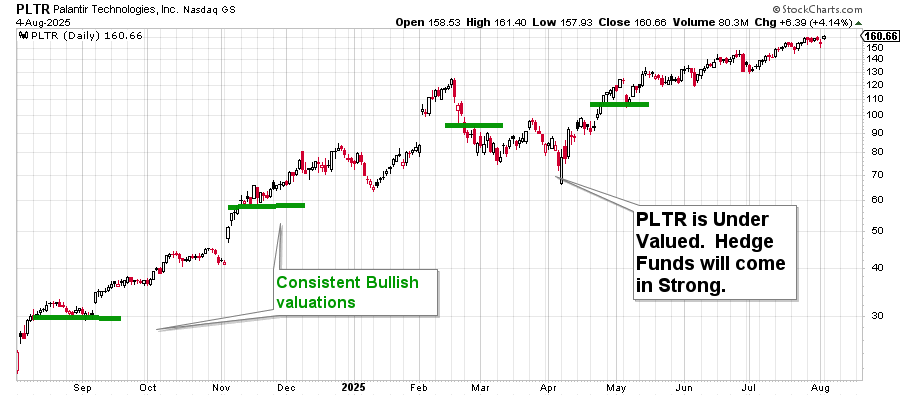

Do we get anything else, or is it just the reports?

Again, we are not marketers that entice you with a lot of 'bonuses and teasers". However, what you do get is our weekly and monthly commentary and charts, as well as longer term economic models and individual stock information.

Yes, we give you institutional information on attractive purchases and accumulation that could create great opportunities for you IF it is in line with the overall direction of the $SPX / SPY which will help push it.

"OK but for reals, how can y'all possibly sell all this for less than three hundred bucks?!"

Simple: First off, digital products have virtually zero overhead or shipping costs...

Secondly, we both have spent the greater part of our lives helping folks launch and scale their online businesses, and thought..

"How cool would it be to exponentially increase the number of people we can serve by creating an insane level of value at a price just about anyone can afford?!"

And of course, we're also doing this to generate revenue. Can't be more direct than that. Something I (Aaron) learned a long time ago from Frank is that, if you sell someone a product that really stands out and help folks get results, these folks will come back and buy even more of your stuff!

So anyway - now that we've appealed to your logical and emotional sides, it's time to get the offer :)

YOUR PURCHASE IS BACKED BY OUR INDUSTRY LEADING 30 DAY GUARANTEE!

"Spend a full 30 days leveraging and testing these powerful tools and training and if you're not 100% satisfied for any reason, we'll issue a full refund. I've spend the better part of three decades crafting and refining these systems and I can't wait to hear about your results!"*

Disclaimers

*this is a private message and only intended for the individual private member of our private association. Those not members are not allowed to read or use this information in any way.

Only members of our Private Association are allowed to purchase any of our products and do business together on any level.

CONFIDENTIALITY: The information contained in this e-mail message and accompanying documents are covered by the Electronic Communications Privacy Act, 18 U.S.C. 2510-2521 and contains confidential information intended only for use by the specified individual(s) and/or entity(s) named above. If you are not the intended recipient, or the employee or agent responsible for delivering it to the intended recipient, you are hereby notified that you have received this e-mail in error and any review, dissemination, copying or the taking of any action based on the contents of this communication and/or attached documents is strictly prohibited. If you have received this communication in error, please notify us immediately by telephone or email and delete the original message without making a copy. This message, together with any attachments, is intended for the use of the individual or entity to which it is addressed and contains information that is confidential and protected.

iWAVE.Pro Report Disclaimers & Disclosures

iWAVE.Pro is a stock analyst & a financial publisher which, along with its related publications, and other products (collectively, iWAVE products), is prepared and offered to professionals on a free & paid basis. We are not registered as an investment adviser; rather it relies upon the "publisher exclusion" from the definition of "investment adviser" as provided under Section 202 (a)(11) of the Investment Advisers Act of 1940 and corresponding state securities laws. This site, service and course is a bona fide publication of general and regular circulation offering investment-related advice to subscribers and/or prospective subscribers (e.g., not tailored to the specific investment needs of current and/or prospective subscribers.)

iWAVE report is strictly a research publishing firm and falls within the publisher's exemption of the definition of an investment advisor and is of general and regular circulation. None of our trading or investing newsletters, services, interviews, educational programs or any other form of communication provides individual customized investment advice. The information we provide and publish is based on our opinions plus our statistical and financial data and independent research and since we are not issuing advice, signals or research on any publicly traded product the information in this service and course is for research and entertainment purposes only. They do not reflect the views or opinions of any other newsletter. The signals you see on the charts provided on our website, emails and/or publications represent the signals of the iWave method of both advanced and basic signals and you should look at the charts carefully to determine whether they will benefit you before considering this service.

*above possibilities are for entertainment purposes only. Stocks & Options are for advanced traders only and not for beginners. Disclaimer below must be adhered to and understood.

When we use terms such as “Hedge Funds, Hedge Fund trader, institutional activity…etc” those are terms we use for our own proprietary calculations and data tracking and is in no way to be taken as the actual institutions or hedge funds portfolio positions even though that is part of our analysis. Our terms are used for our own opinions of analysis.

We are strictly a financial publisher and do not provide personalized trading or investment advice. Again, we are a financial publisher. We may publish information regarding stocks, ETFs or any other equity securities in which we believe our subscribers may be interested and our reports reflect our sincere opinions. However, the information in our publications is not intended to be personalized recommendations to buy, hold, or sell a particular security or invest in securities. As a financial publisher, we do not or cannot offer personalized trading or investment advice to our subscribers. If a subscriber chooses to engage in trading or investing that he or she does not fully understand, we may not advise the subscriber on what to do to salvage a position gone wrong. We also may not address winning positions or personal trading or investing ideas with subscribers. Therefore, subscribers will need to depend on their own mastery of the details of trading and investing in order to handle problematic situations that may arise, including the consultation of their own brokers and financial advisors, as they deem appropriate.

Neither the Editor, the publisher, nor any of its employees or members is responsible for any errors or omissions in any of our newsletters or educational products. The commentary, analysis, opinions, advice and recommendations in the course represent the personal and subjective views of the Editor, and are subject to change at any time without notice. The information provided in our newsletters contains material, which is obtained from sources, which the Editor believes to be reliable. However, the Editor has not independently verified or otherwise investigated all such information. Neither the Editor, the publisher, nor any of their respective affiliates guarantees the accuracy or completeness of any such information. Our newsletters and Educational material are not a solicitation or offer to buy or sell any securities. Your actual results may differ from any results reported for the free videos and advanced member's area (when added) for many reasons, including, without limitation: performance results do not reflect actual trading commissions that you may incur; performance results do not account for the impact, if any, of certain market factors, such as lack of liquidity, that may affect your results. The signals you see are merely the signals of the iWave system which you are subscribing to and we are in no way giving financial advice. You are to use it how you choose as a tool in your own research.

Past results are not indicative of future performance/results. Investing involves substantial risk. Neither the Editor, the publisher, nor any of their respective affiliates make any guarantee or other promise as to any results that may be obtained from using any product. Past performance should not be considered indicative of future performance. No subscriber should make any investment decision without first consulting his or her own personal financial advisor and conducting his or her own research and due diligence. To the maximum extent permitted by law, the Editor, the publisher and their respective affiliates disclaim any and all liability in the event any information, commentary, analysis, opinions and/or recommendations in any product prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses. Don't enter any trade without fully understanding the worst-case scenarios of that trade. Profits can be lost if they are not taken at the right time. Subscribers are advised to take profits at whatever point they deem optimal, regardless of any profit target set in any given recommendation or waiting for reversal signal. Publications such as those we offer provide recommendations. Subscribers are free to follow the recommendation, follow it in part, or ignore it altogether. If a subscriber believes a given profit is atrisk, the subscriber should take the profit. Similarly, if a subscriber feels a position is likely to lose value, or a losing position is likely to fall further, the subscriber can choose to exit at any time to preserve capital. The final decision as to when to take profits remains in the sole discretion of the subscriber, keeping in mind that profits can be lost if they are not taken at the right time.

Since we send out signals based on the overall stock market ($SPX, SPY, QQQ), and individual equities there are a variety of instruments that can be traded by subscribers and they may differ in direction dramatically so we are not responsible for any of your personal trading decisions or losses or advice on your particular instrument you decided to trade. Subscribers may submit questions to us by writing to [email protected] This e-mail address is being protected from spambots. You need JavaScript enabled to view it. However, since any product is impersonal and does not provide individualized advice for specific subscribers, the Editor can only answer questions of a general nature about the markets or specific securities.

GENERAL RISKS OF TRADING AND INVESTING We believe it is vitally important that you read and fully understand the following risks of trading and investing: All securities trading, whether in stocks, ETFs, or other investment vehicles, is speculative in nature and involves substantial risk of loss. We encourage our subscribers to invest carefully and to utilize the information available at the websites of the Securities and Exchange Commission at http://www.sec.gov and the National Association of Securities Dealers at http://www.nasd.com. You can review public companies filings at the SEC's EDGAR page. The NASD has published information on how to invest carefully at its website. We also encourage you to get personal advice from your professional investment advisor and to make independent investigations before acting on information that we publish. Most of our information, which we analyze, and/or rate from other sources we believe are reliable, without our independent verification. Therefore, we cannot assure you that the information is accurate or complete. We do not in any way warrant or guarantee the success of any action you take in reliance on our statements, ratings, or recommendations. FTC requires us to state that the average individual using any information from this website will not make any profit or profit in any way. You may lose money trading and investing. Trading and investing in securities is always risky. For that reason, you should trade or invest only "risk capital" — money you can afford to lose. While this is an individual matter, we recommend that you risk no more than 20% of your liquid net worth — and, in some cases, you should risk less than that. For example, if 20% of your liquid net worth represents your entire retirement savings, you should not use that amount to buy and sell securities. Trading stock and ETFs involves HIGH RISK and YOU can LOSE a lot of money.

Past performance is not necessarily indicative of future results. All investments carry risk and all trading decisions of an individual remain the responsibility of that individual. There is no guarantee that systems, indicators, or trading signals will result in profits or that they will not result in losses. All investors are advised to fully understand all risks associated with any kind of trading or investing they choose to do.

Hypothetical or simulated performance is not indicative of future results. Unless specifically noted otherwise, all profit examples & chart signals provided in the our websites and publications are based on hypothetical or simulated trading, which means they are done on paper or electronically based on real market prices at the time the recommendation is disseminated to the subscribers of this service, but without actual money being invested.

Because the trades underlying these examples have not actually been executed, the results may understate or overstate the impact of certain market factors, such as lack of liquidity (discussed below). Simulated trading programs in general are also designed with the benefit of hindsight, which may not be relevant to actual trading. We make no representations or warranties that any account will or is likely to achieve profits similar to those shown, because hypothetical or simulated performance is not necessarily indicative of future results. Don't enter any trade without fully understanding the worst-case scenarios of that trade. Trading securities like stock or ETFs can be extremely complicated, so make sure you understand these trades before entering into them. We are a financial publisher and do not provide personalized trading or investment advice. We are a financial publisher. We publish information regarding companies in which we believe our subscribers may be interested and our reports reflect our sincere opinions. However, the information in our publications is not intended to be personalized recommendations to buy, hold, or sell securities. As a financial publisher, we are not legally permitted to offer personalized trading or investment advice to our subscribers. If a subscriber chooses to engage in trading or investing that he or she does not fully understand, we may not advise the subscriber on what to do to salvage a position gone wrong. We also may not address winning positions or personal trading or investing ideas with subscribers. Therefore, subscribers will need to depend on their own mastery of the details of trading and investing in order to handle problematic situations that may arise, including the consultation of their own brokers and advisors as they deem appropriate.

Profits can be lost if they are not taken at the right time. Subscribers are advised to take profits at whatever point they deem optimal, regardless of the profit target set in any given signal and that the signals may continue until a reversing signal occurs. Publications such as those we offer provide recommendations. Subscribers are free to follow the recommendation, follow it in part, or ignore it altogether. If a subscriber believes a given profit is at risk, the subscriber should take the profit. Similarly, if a subscriber feels a position is likely to lose value, or a losing position is likely to fall further, the subscriber can choose to exit at any time to preserve capital. The final decision as to when to take profits remains in the sole discretion of the subscriber, keeping in mind that profits can be lost if they are not taken at the right time. RISKS OF INVESTING IN STOCK Investments always entail some degree of risk. Be aware that: Some investments in stock cannot easily be sold or converted to cash. Check to see if there is any penalty or charge if you must sell an investment quickly. Investments in stock issued by a company with little or no operating history or published information involves greater risk than investing in a public company with an operating history and extensive public information. There are additional risks if that is a low priced stock with a limited trading market, e.g., so-called penny stocks. Stock investments, including mutual funds, are not federally insured against a loss in market value. Stock you own may be subject to tender offers, mergers, reorganizations, or third-party actions that can affect the value of your ownership interest. Pay careful attention to public announcements and information sent to you about such transactions. They involve complex investment decisions. Be sure you fully understand the terms of any offer to exchange or sell your shares before you act.

In some cases, such as partial or two-tier tender offers, failure to act can have detrimental effects on your investment. The greatest risk in buying shares of stock is having the value of the stock fall to zero. On the other hand, the risk of selling stock short can be substantial. "Short selling" means selling stock that the seller does not own, or any sale that is completed by the delivery of a security borrowed by the seller. Short selling is a legitimate trading strategy, but assumes that the seller will be able to buy the stock at a more favorable price than the price at which they sold short. If this is not the case, then the seller will be liable for the increase in price of the shorted stock, which could be substantial. Regulations require us to state that trading is risky and should be done with capital one can afford to risk. Past performance is no guarantee of future results and this website, signal service & trading courses are to be considered with your own analysis. All trading decisions are yours and this company, individual, morning report or website is not responsible for any losses incurred from your trading decisions.

All actions to be taken by you for trading decisions are your sole responsibility. We are not advisors and this is not intended for financial advice but merely a tool and/or indicator for you to use in your analysis. Even though the signals and claims on the above charts were given out in real time, they must be considered hypothetical which has certain inherent limitations. You should carefully evaluate the charts above to see if this tool can benefit you before ever sending in payment or starting a trial. The cancellation responsibility is yours alone through paypal. We have made every attempt to put accurate signals and analysis on the charts above.

Options involve risk and are not suitable for all investors. Before trading options, please read Characteristics and Risks of Standardized Options (ODD) which can be obtained from your broker; by emailing [email protected]; or from The Options Clearing Corporation, 125 S. Franklin St., Suite 1200, Chicago, IL 60606. The content on this site is intended to be educational and/or informative in nature. No statement on this site is intended to be a recommendation or solicitation to buy or sell any security or to provide trading or investment advice. Traders and investors considering options should consult a professional tax advisor as to how taxes may affect the outcome of contemplated options transactions.

Investing in Any and ALL financial instruments contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Directional indications are not trading recommendations and no statement of market direction is making any representation of trading as there is more to trading profitably than merely predicting a direction so a any statement is not representing that nor representing that any trades have or have not been taken based on this information. The information given is purely for entertainment value.

*The 30 day refund guarantee only applies to those that have not had a free trial or to those that have not had a membership previously at any time in the past.

If Subscriber and/or member is new but has had a free trial or has been a member at anytime in the past, then refunds are not allowed once member signs up.

*Directional indications are not trading recommendations and no statement of market direction is making any representation of trading as there is more to trading profitably than merely predicting a direction so a any statement is not representing that nor representing that any trades have or have not been taken based on this information. The information given is purely for entertainment value.

Each member must schedule their own strategy session with support at the beginning of their membership to be eligible for any refunds. It is not the responsibility of iwave Traders Association to make sure contents of reports or any information given to members is understood so member can benefit from it unless a strategy session is booked and scheduled by member within the first 7 days of membership. Without this being done by member within first week of membership refunds are not eligible as member loses privilege of any requested refund no matter whether it being a trial or not

There are No refunds on subscription automatic renewals after charge has auto renewed. Subscriptions are fully managed by you through your account on PayPal.com or stripe and we do not manage it for you nor handle cancellations. It is fully up to you to cancel your subscription BEFORE it auto renews as no refunds are given on annual auto renewing charges. Simply sending us an email cancelling does not entitle you to a refund if your subscription automatically renews. You can contact your account at www.PayPal.com if your payment was billed through them or www.Stripe.com if your payment was processed through them.

- All rights reserved